If Cash Ledger is not Generated then You Should Create Cash Ledger First.

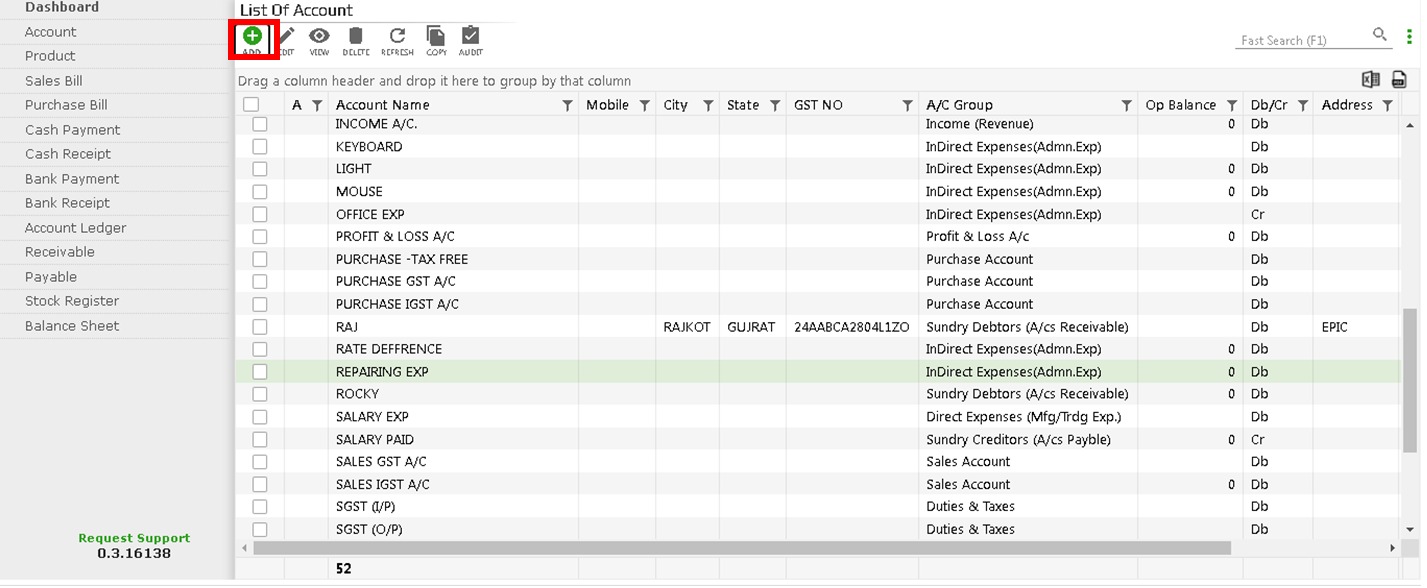

Step: 1

To Create a Cash Ledger,

Click on Master -> Click on Add

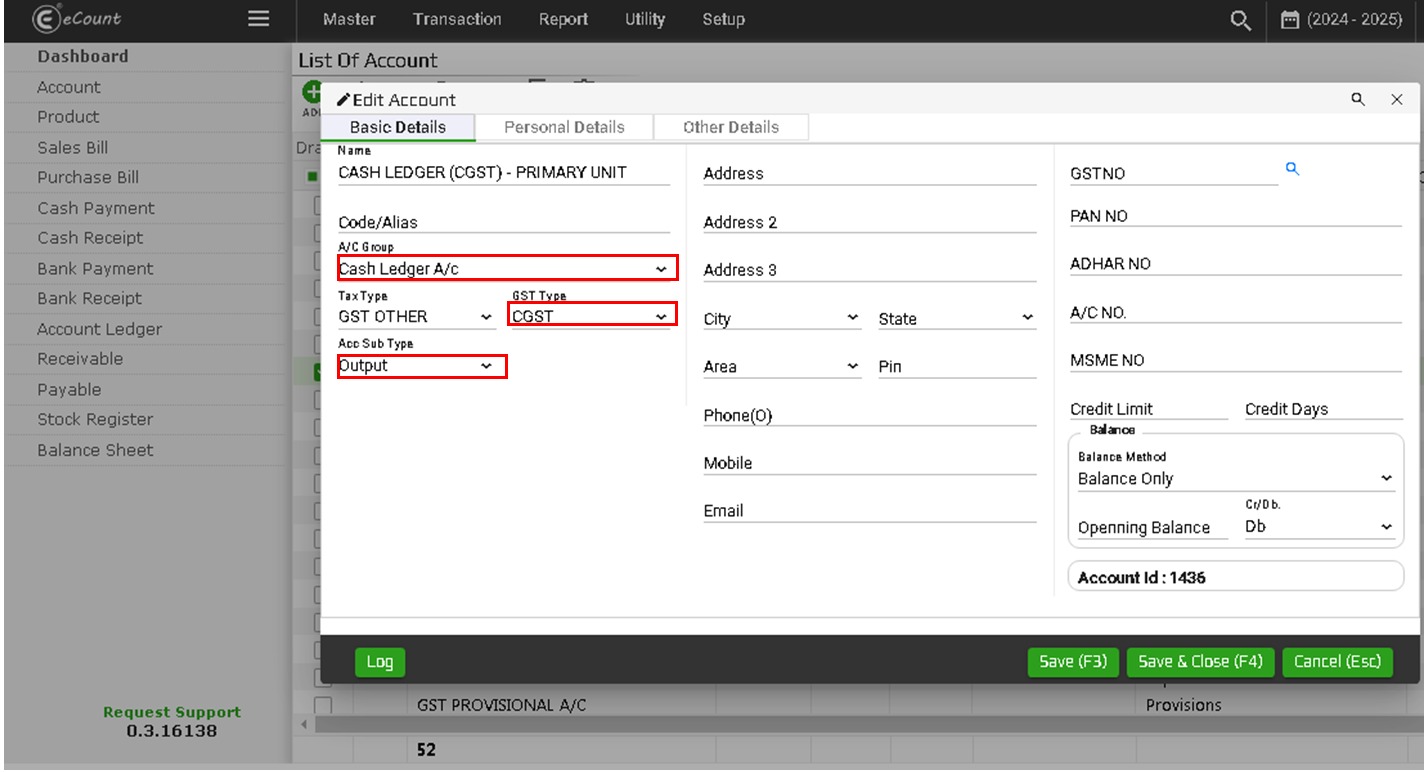

Step: 2

Remind These Mandatory Fields.

A/C Group Should Cash Ledger A/c.

GST Type should CGST when you are creating CGST Cash Ledger.

Acc Sub Type should Output for O/P Cash Ledger.

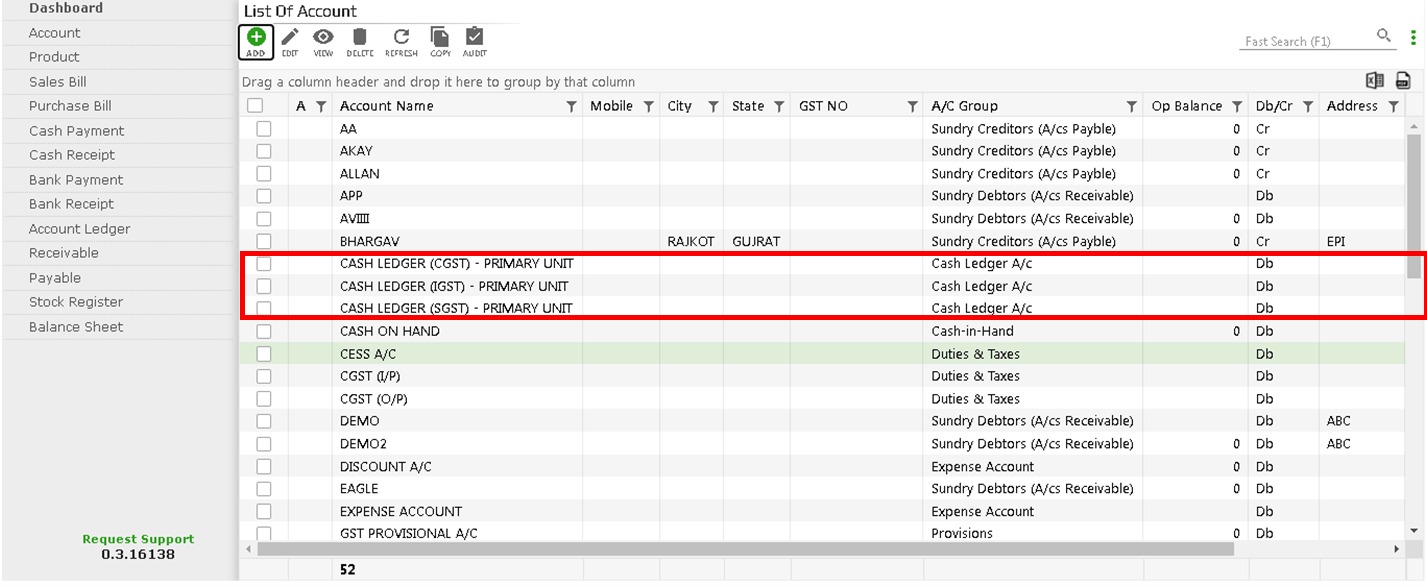

step: 3

According Above Steps, Create Another 2 Cash Ledger of SGST and IGST.

Step: 4

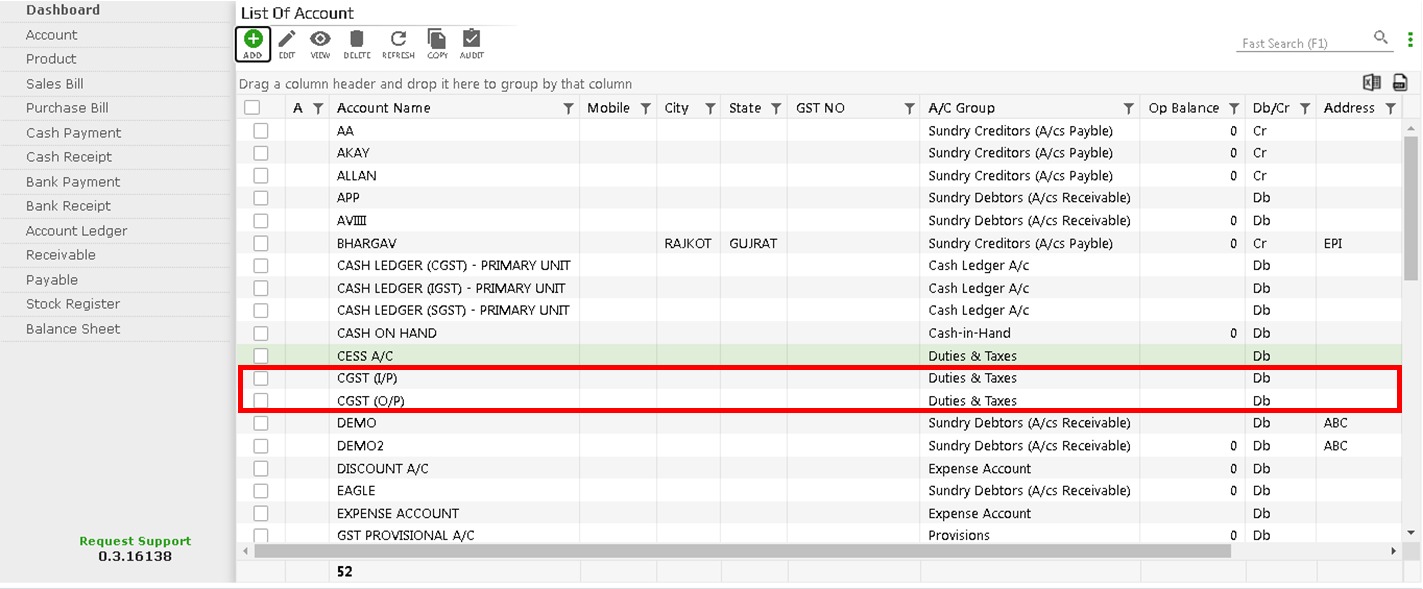

If Duties and Taxes Acc is not Generated then You Should Create them First.

To Create Duties and Taxes Acc click on Add ->

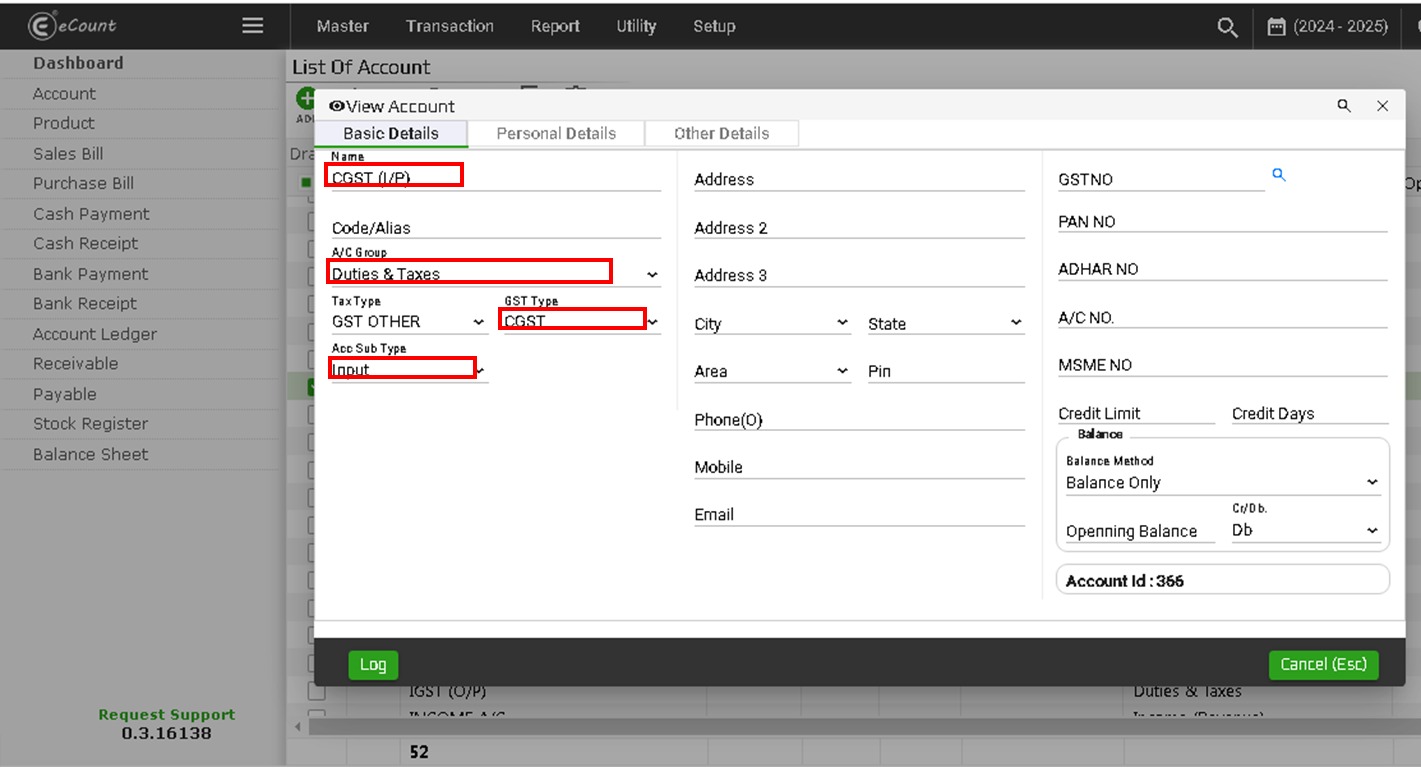

Mandatory Fields are below:

type CGST(I/P) when you are creating input Acc of CGST.

select Duties & Taxes in A.C group.

Select CGST in GST Type to create CGST (I/P).

Select Input in Acc sub Type.

Step: 5

According to above steps create another Duties & Taxes Acc of CGST (O/P).

Step: 6

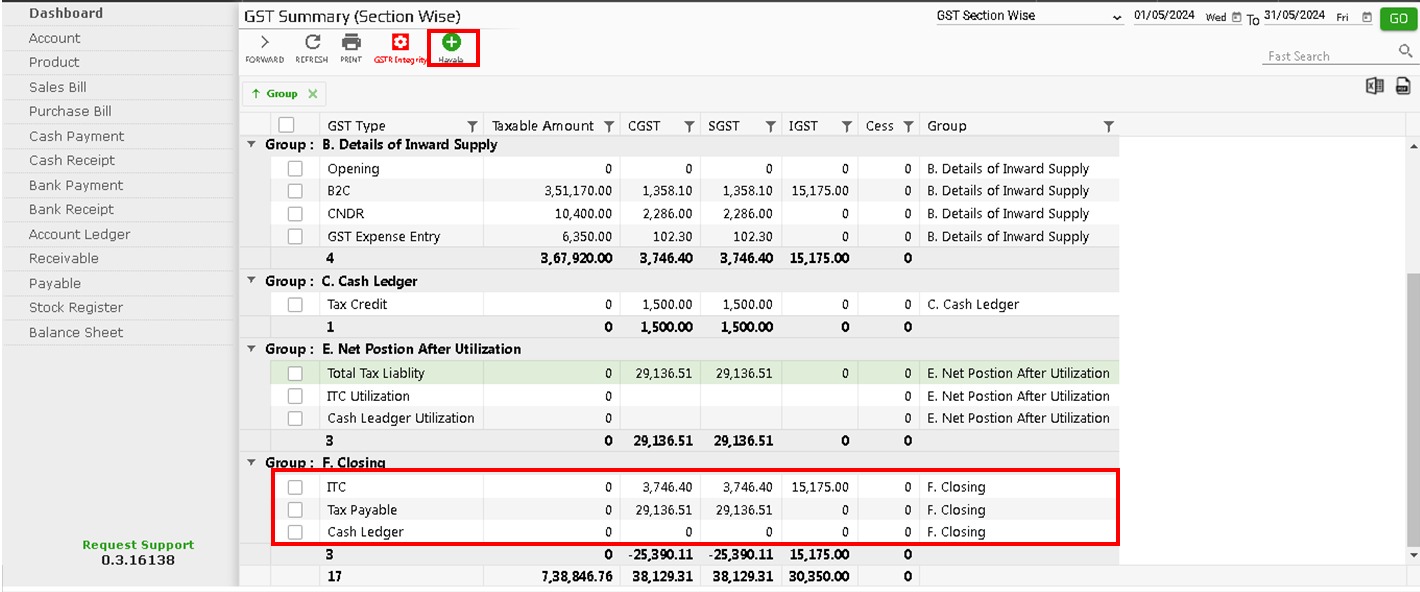

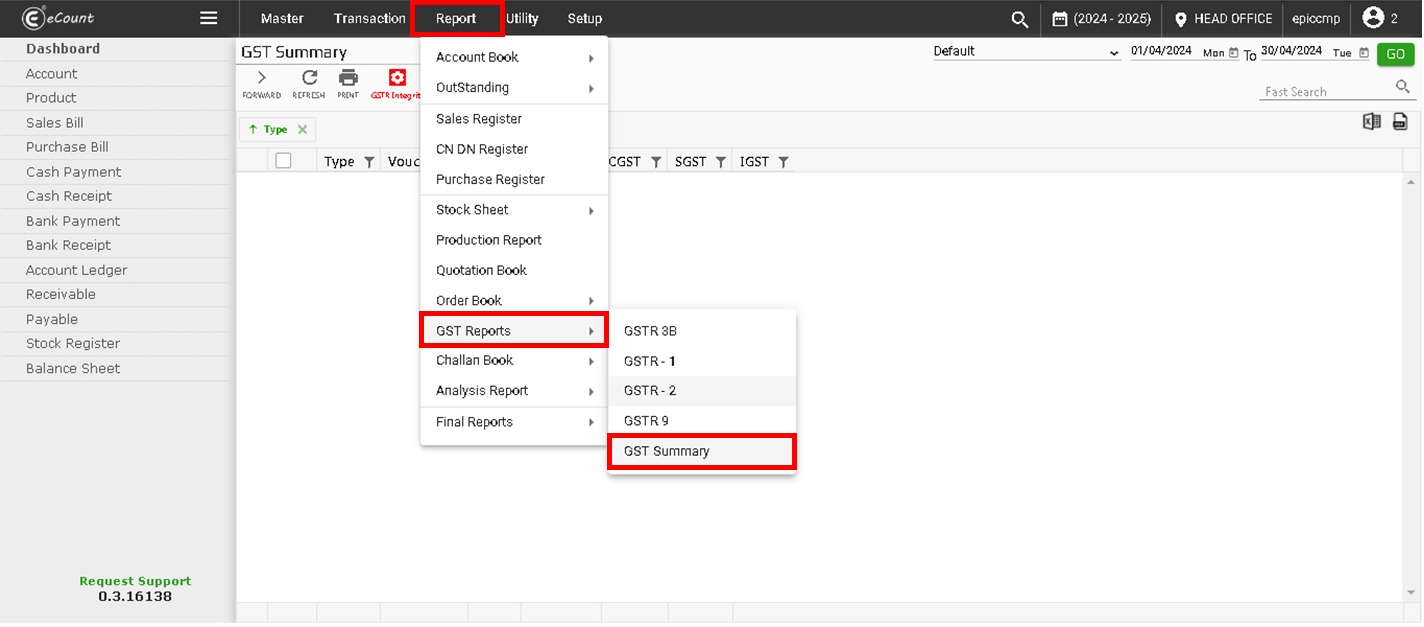

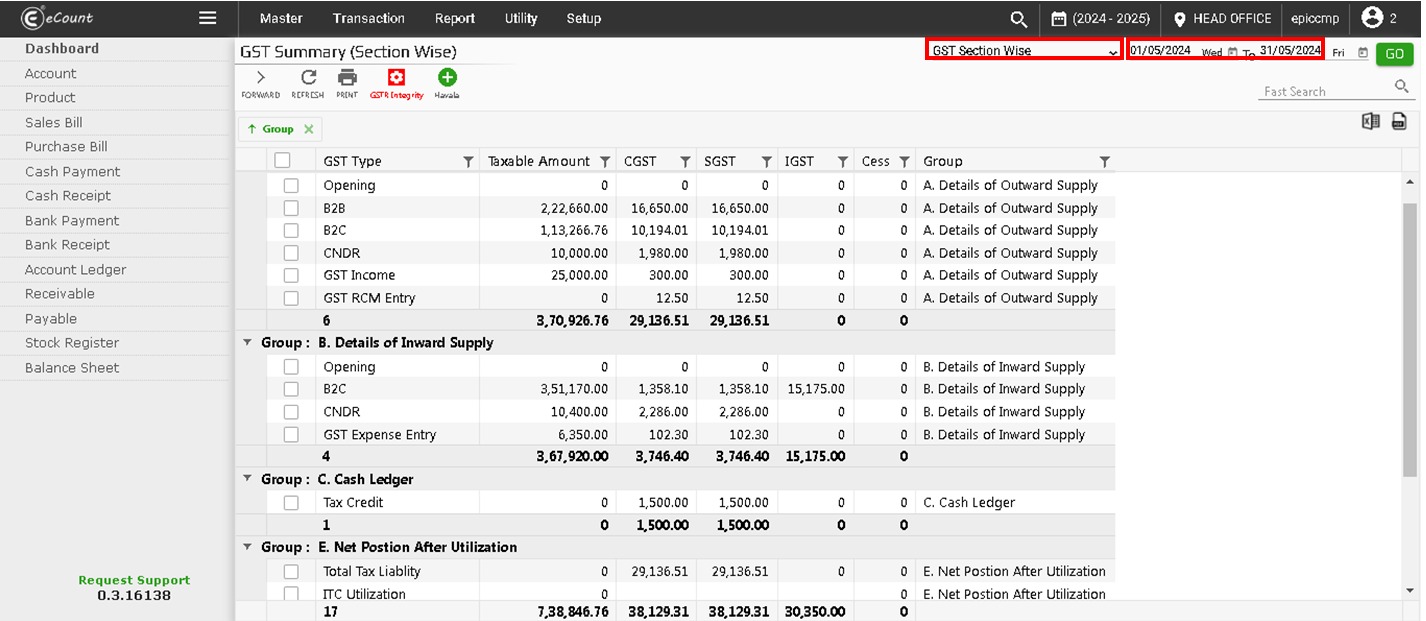

Then click on Report -> GST Reports -> GST Summary

Step: 7

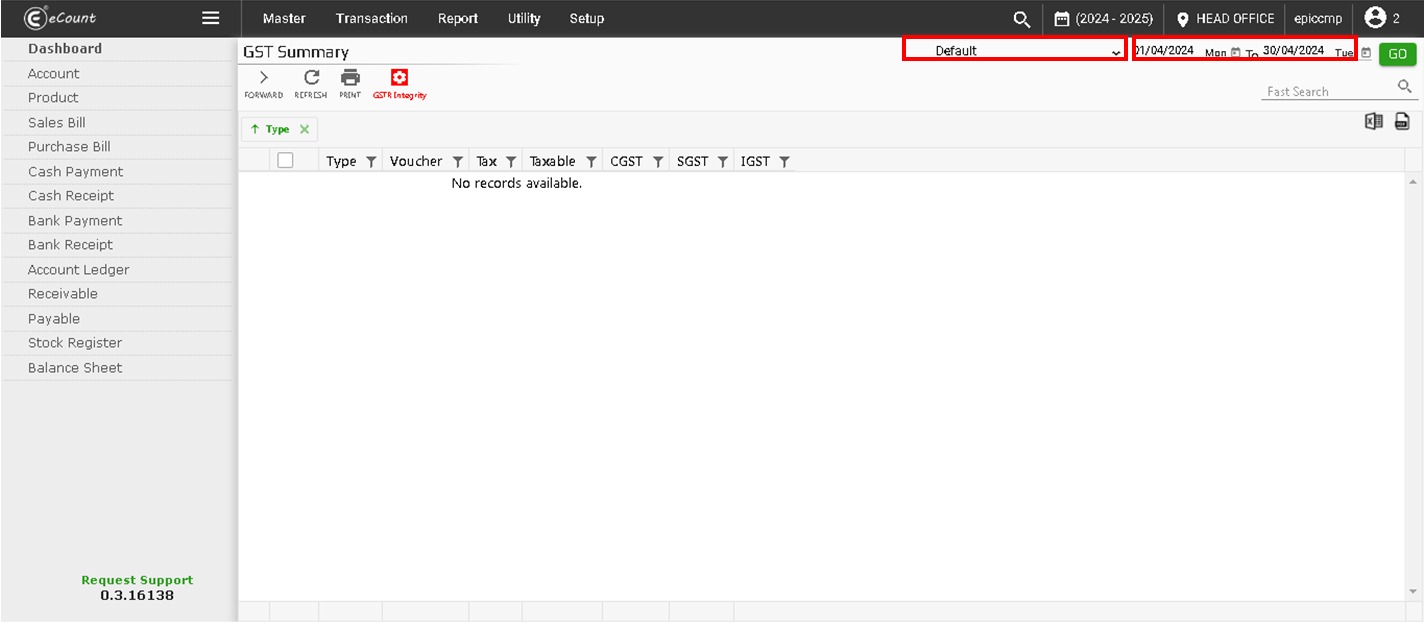

Select GST Section Wise instead of this and select date range which month’s GST Utilization you want instead of this Month.

Step: 8

When Tax Payable shows more than ITC, then it will go to A/c Of Cash Ledger.

Then Select ITC and click on Hawala.

also Select Tax Payable and click on Hawala.